UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

EOG Resources, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| ☑ | No fee required. |

|

|

|

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

| ☐ |

|

|

|

|

|

Notice of 2022 Annual Meeting of

Stockholders and Proxy Statement

Wednesday, April 20, 2022

EOG RESOURCES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

APRIL 30, 202020, 2022

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 20202022 annual meeting of stockholders (“Annual Meeting”) of EOG Resources, Inc. will be held at Heritage Plaza, 1111 Bagby, Houston, Texas 77002,in a virtual-only format, via live webcast, on Wednesday, April 20, 2022 at 2:00 p.m., Central Time, on Thursday, April 30, 2020, for the following purposes:

1. To elect eightten directors to hold office until the 20212023 annual meeting of stockholders and until their respective successors are duly elected and qualified;

2. To ratify the appointment by the Audit Committee of the Board of Directors of Deloitte & Touche LLP, independent registered public accounting firm, as our auditors for the year ending December 31, 2020;2022;

3. To hold anon-binding advisory vote on executive compensation; and

4. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

Holders of record of our Common Stock at the close of business on March 6, 2020February 24, 2022 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting and any adjournments thereof.

Beginning on or about March 20, 2020,10, 2022, the Companycompany is mailing a Notice Regarding the Availability of Proxy Materials (the “Notice”) to our stockholders of record as of the Record Date (but excluding those stockholders who have previously requested a printed copy of our proxy materials) containing instructions on how to access the proxy materials (including our 20192021 annual report) via the Internet, as well as instructions on voting shares via the Internet. The Notice also contains instructions on how to request a printed copy of the proxy materials by mail or an electronic copy of the proxy materials by email.

Stockholders who dowill not expectbe able to attend the Annual Meeting in person. The Annual Meeting will be held at www.virtualshareholdermeeting.com/EOG2022. To participate in, and vote at, the live webcast of the Annual Meeting, you must enter the 16-digit control number included in the Notice, on your proxy card or in the voting instruction form provided to you with the proxy statement.

Whether or not stockholders plan to participate in the live webcast of the Annual Meeting, stockholders are encouraged to vote and submit their proxies in advance of the Annual Meeting via the Internet at www.proxyvote.com, using the instructions on the Notice or, if you received a printed copy of the proxy materials (which includes the proxy card), by signing and returning the proxy card in thepre-paid envelope provided or by voting via the Internet or by phone using the instructions provided on the proxy card.

By Order of the Board of Directors, |

|

MICHAEL P. DONALDSON |

| Corporate Secretary |

Houston, Texas

March 20, 202010, 2022

i

EOG RESOURCES, INC.

PROXY STATEMENT

The accompanying form of proxy is solicited by the Board of Directors (“Board”) of EOG Resources, Inc. (“EOG,” “we,” “us,” “our” or “company”) to be used at our 20202022 annual meeting of stockholders (“Annual Meeting”) to be held at Heritage Plaza, 1111 Bagby, Houston, Texas 77002,in a virtual-only format, via live webcast, on Wednesday, April 20, 2022 at 2:00 p.m., Central Time, on Thursday, April 30, 2020.Time. The proxy materials, including this proxy statement, the accompanying notice of annual meeting of stockholders and form of proxy and our 20192021 annual report, are being first distributed and made available to our stockholders on or about March 20, 2020.10, 2022.

Any stockholder giving a proxy may revoke it at any time provided written notice of the revocation is received by our Corporate Secretary before the proxy is voted; otherwise, if received prior to or at the Annual Meeting, properly executed proxies will be voted at the Annual Meeting in accordance with the instructions specified on the proxy or, if no such instructions are given, in accordance with the recommendations of the Board described herein. Stockholders attendingparticipating in the live webcast of the Annual Meeting may revoke their proxies and vote in person. If you would likeduring the Annual Meeting via the meeting website.

You will not be able to attend the Annual Meeting you may contact our Corporate Secretary (Michael P. Donaldson) at (713)651-7000in person. We believe the live-webcast format for directions to the Annual Meeting. To vote in person at the Annual Meeting will provide stockholders with a consistent experience and will allow you must (1)to participate in the Annual Meeting regardless of your location. You will be able to submit questions during the Annual Meeting via the meeting website.

You are entitled to participate in, and vote at, the live webcast of the Annual Meeting if you were a holderstockholder of record of our Common Stock as of the close of business on March 6, 2020February 24, 2022 (the “Record Date”) or (2) obtain a valid proxy from the record holder of the shares if you were, as of the Record Date, a beneficial owner of our common stock. The Annual Meeting will be held at www.virtualshareholdermeeting.com/EOG2022. To participate in, street name; follow the instructions of your bank, broker or other nominee to obtain such a proxy.

Attendanceand vote at, the Annual Meeting is limited to holderslive webcast of record of our Common Stock as of the Record Date and EOG’s guests. Admission will be on a first-come, first-served basis. You will be asked to present valid government-issued picture identification, such as a driver’s license or passport, in order to be admitted into the Annual Meeting. If your shares are held in the name of a bank, broker or other nominee and you plan to attend the Annual Meeting, you must present proofenter the 16-digit control number included in the Notice Regarding the Availability of Proxy Materials, on your ownership of our Common Stock, such asproxy card or in the voting instruction form provided to you with this proxy statement. Further, to vote during the Annual Meeting, click the “Vote Now” button on the meeting website and follow the instructions provided. Guests without a bank or brokerage account statement indicating that you owned shares of our Common Stock as of the Record Date, in order to be admitted. For safety and security reasons, no cameras, recording equipment or other electronic devices will be permittedcontrol number may also participate in the Annual Meeting. A written agendaMeeting, but will not be permitted to vote or submit questions.

As part of the Annual Meeting, we will hold a live Q&A session during which we intend, time permitting, to answer questions submitted during the meeting that are pertinent to EOG’s business and meeting matters. As noted above, you will be able to submit questions during the Annual Meeting by following the instructions available on the meeting website. Questions and answers may be grouped by topic and substantially similar questions will be grouped and answered once. Further, we reserve the right to edit or reject questions we deem inappropriate.

Additional information regarding the rules of procedureand procedures for participating in the Annual Meeting will be distributedset forth in our meeting rules of conduct, which will be available at www.proxyvote.com during the 10 days prior to those personsthe Annual Meeting, and on the meeting website during the Annual Meeting.

You may log into the meeting website beginning at 1:30 p.m., Central Time, on April 20, 2022. The Annual Meeting will begin promptly at 2:00 p.m., Central Time, on April 20, 2022. If you experience any technical difficulties accessing the meeting website, a toll-free technical support number will be posted on the meeting website (on the meeting log-in page); you can dial such number to receive technical assistance. The meeting website is fully supported across browsers (Chrome, Firefox, Safari and Edge) and devices (desktops, laptops and cell phones) running the most updated version of applicable software and plug-ins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in attendance.the Annual Meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

If you are not able to participate in the Annual Meeting, a webcast playback will be available at www.virtualshareholdermeeting.com/EOG2022 approximately 24 hours after the completion of the Annual Meeting and for a period of 30 days thereafter.

Whether or not you plan to participate in the live webcast of the Annual Meeting, it is important that your shares be represented and voted. We encourage you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the Annual Meeting further discussed below.

If you received a printed copy of the proxy materials, you also received a copy of our 20192021 annual report. However, the 20192021 annual report does not constitute a part of, and shall not be deemed incorporated by reference into, this proxy statement or the accompanying form of proxy.

In addition to solicitation by mail, certain of our officers and employees may solicit the return of proxies personally or by telephone, electronic mail or facsimile. The cost of any solicitation of proxies will be borne by us. Arrangements may also be made with brokerage firms and other custodians, nominees and fiduciaries for the forwarding of materialmaterials to, and solicitation of proxies from, the beneficial owners of our Common Stock held of record as of the Record Date by such persons. We will reimburse such brokerage firms, custodians, nominees and fiduciaries for the reasonableout-of-pocket expenses incurred by them in connection with any such activities.

In some cases, one paper copy of this proxy statement and the accompanying notice of annual meeting of stockholders and the 20192021 annual report is being delivered to multiple stockholders sharing an address, at the

request of such stockholders. We will deliver promptly, upon written or oral request, an additional paper copy of this proxy statement, the accompanying notice of annual meeting of stockholders and/or the 20192021 annual report to such a stockholder at a shared address to which a single paper copy of such document was delivered. Stockholders sharing an address who receive multiple printed copies of our proxy materials and who wish to receive a single printed copy of our proxy materials may also submit requests for delivery of a single paper copy of this proxy statement or the accompanying notice of annual meeting of stockholders or the 20192021 annual report, but, in such event, will still receive separate forms of proxy for each account. To request separate or single delivery of these materials now or in the future, a stockholder may submit a written request to our Corporate Secretary (Michael P. Donaldson) at our principal executive offices at 1111 Bagby, Sky Lobby 2, Houston, Texas 77002, or a stockholder may make a request by calling our Corporate Secretary at (713)651-7000.

A complete list of stockholders entitled to vote atduring the Annual Meeting will be available to such stockholders on the meeting website to view during the Annual Meeting. You may also inspect this list at our principal executive offices, for any purpose germane to the Annual Meeting, during ordinary business hours, for a period of 10 days prior to the Annual Meeting.

The mailing address of our principal executive offices is 1111 Bagby, Sky Lobby 2, Houston, Texas 77002.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on April 30, 202020, 2022

This proxy statement, the accompanying notice of annual meeting of stockholders and form of proxy and our 20192021 annual report are available via the Internet at www.proxyvote.com. Pursuant to United States Securities and Exchange Commission (“SEC”) rules related to the Internet availability of proxy materials, we have elected to provide access to our proxy materials on the Internet instead of mailing a printed copy of the proxy materials to each stockholder of record.

Accordingly, beginning on or about March 20, 2020,10, 2022, we are mailing a Notice Regarding the Availability of Proxy Materials (the “Notice”) to our stockholders of record as of the Record Date (but excluding those stockholders who have previously requested a printed copy of our proxy materials) in lieu of mailing the printed proxy materials. Instructions on how to access the proxy materials via the Internet, on voting shares via the Internet and on how to request a printed or electronic copy of the proxy materials may be found in the Notice. All stockholders will have the option to access our proxy materials on the website referred to above.

Stockholders will not receive printed copies of the proxy materials unless they request (or have previously requested) such form of delivery. Printed copies will be provided upon request at no charge. In addition, stockholders may request to receive future proxy materials in printed form by mail or electronically by email on an ongoing basis. A request to receive proxy materials in printed form by mail or electronically by email will remain in effect until the stockholder terminates such request.

Stockholders who do not expect to attendparticipate in the live webcast of the Annual Meeting are encouraged to vote in advance of the Annual Meeting via the Internet using the instructions on the Notice or, if you received a printed copy of the proxy materials (which includes the proxy card), by signing and returning the proxy card in thepre-paid envelope provided or by voting via the Internet or by phone using the instructions provided on the proxy card.

VOTING RIGHTS AND PRINCIPAL STOCKHOLDERS

Holders of record of our Common Stock as of the Record Date will be entitled to one vote per share on all matters properly presented at the Annual Meeting. As of the Record Date, there were 582,054,955585,389,455 shares of our Common Stock outstanding. Other than our Common Stock, we have no other voting securities currently outstanding.

Our stockholders do not have dissenters’ rights or similar rights of appraisal with respect to the proposals described herein and do not have cumulative voting rights with respect to the election of directors.

Stock Ownership of Certain Beneficial Owners

The following table sets forth certain information regarding the beneficial ownership of our Common Stock by each person (including any “group” as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934 (as amended, “Exchange Act”)) whom we know beneficially owned more than 5% of our Common Stock as of December 31, 2019,2021, based on filings with the SEC as of February 29, 2020.28, 2022. We have prepared the table and the related notes below based on such filings with the SEC, and we have not sought to independently verify any of such information.

Name and Address | Number of Shares | Percent of Class(a) | ||||||

Capital Research Global Investors(b) 333 South Hope Street, Los Angeles, CA 90071 | 60,548,187 | 10.4 | % | |||||

The Vanguard Group(c) 100 Vanguard Blvd., Malvern, PA 19355 | 46,672,076 | 8.0 | % | |||||

Capital International Investors(d) 11100 Santa Monica Boulevard, 16th Floor, Los Angeles, CA 90025 | 45,635,521 | 7.8 | % | |||||

BlackRock, Inc.(e) 55 East 52nd Street, New York, NY 10055 | 36,752,689 | 6.3 | % | |||||

Name and Address of Beneficial Owner | Number of Shares | Percent of Class(a) | ||||||

The Vanguard Group(b) 100 Vanguard Blvd. Malvern, PA 19355 | 51,345,348 | 8.8 | % | |||||

BlackRock, Inc.(c) 55 East 52nd Street New York, NY 10055 | 46,118,313 | 7.9 | % | |||||

Capital International Investors(d) 333 South Hope Street, 55th Floor Los Angeles, CA 90071 | 43,320,265 | 7.4 | % | |||||

State Street Corporation(e) State Street Financial Center One Lincoln Street Boston, MA 02111 | 36,323,383 | 6.2 | % | |||||

Capital Research Global Investors(f) 333 South Hope Street, 55th Floor Los Angeles, CA 90071 | 33,853,299 | 5.8 | % | |||||

| (a) | Based on |

| (b) | Based on its Schedule 13G/A filed on |

| (c) | Based on its Schedule 13G/A filed on February |

| (d) | Based on its Schedule 13G/A filed on February |

| (e) | Based on its Schedule 13G/A filed on February |

| (f) | Based on its Schedule 13G/A filed on February 11, 2022 with respect to its beneficial ownership of our Common Stock as of December 31, 2021, Capital Research Global Investors has sole voting power with respect to |

Stock Ownership of the Board and Management

The following table sets forth certain information regarding the ownership of our Common Stock by (1) each director and director nominee of EOG, (2) each “Named Officer” of EOG named in the “Summary Compensation Table” in the “Executive Compensation” section below and (3) all current directors and executive officers of EOG as a group, in each case as of February 29, 2020.15, 2022. Under Rule13d-3 under the Exchange Act, a person shall be deemed to be the beneficial owner of a security if that person has the right to acquire beneficial ownership of such security within 60 days. April 29, 202016, 2022 is the date 60 days from February 29, 2020,15, 2022, the date as of which ownership is reported in this table.

Name | Shares Beneficially Owned(a) | Stock-Settled Stock Appreciation Rights Exercisable by 4-29-20(b) | Total Beneficial Ownership | Restricted Stock Units, Performance Units and Phantom Shares(c) | Total Ownership(d) | |||||||||||||||

Janet F. Clark | 568 | 0 | 568 | 18,830 | 19,398 | |||||||||||||||

Charles R. Crisp | 26,923 | 0 | 26,923 | 21,897 | 48,820 | |||||||||||||||

Robert P. Daniels | 0 | 0 | 0 | 6,676 | 6,676 | |||||||||||||||

James C. Day | 28,934 | 5 | 28,939 | 11,737 | 40,676 | |||||||||||||||

Michael P. Donaldson | 75,760 | 0 | 75,760 | 70,240 | 146,000 | |||||||||||||||

Timothy K. Driggers | 178,977 | 0 | 178,977 | 68,342 | 247,319 | |||||||||||||||

C. Christopher Gaut | 500 | 0 | 500 | 4,387 | 4,887 | |||||||||||||||

Lloyd W. Helms, Jr. | 62,377 | 0 | 62,377 | 107,809 | 170,186 | |||||||||||||||

Julie J. Robertson | 493 | 0 | 493 | 1,972 | 2,465 | |||||||||||||||

Donald F. Textor | 72,651 | 0 | 72,651 | 70,928 | 143,579 | |||||||||||||||

William R. Thomas | 502,125 | 0 | 502,125 | 359,700 | 861,825 | |||||||||||||||

Ezra Y. Yacob | 50,508 | 0 | 50,508 | 20,909 | 71,417 | |||||||||||||||

All current directors and executive officers as a group (13 in number) | 1,025,083 | 5 | 1,025,088 | 780,068 | 1,805,156 | |||||||||||||||

Name | Shares Beneficially Owned(a) | Stock-Settled Stock Appreciation Rights Exercisable by 4-16-22(b) | Total Beneficial Ownership | Restricted Stock Units, Performance Units and Phantom Shares(c) | Total Ownership(d) | |||||||||||||||

Janet F. Clark | 568 | 0 | 568 | 30,867 | 31,435 | |||||||||||||||

Charles R. Crisp | 26,923 | 0 | 26,923 | 30,563 | 57,486 | |||||||||||||||

Robert P. Daniels | 0 | 0 | 0 | 17,539 | 17,539 | |||||||||||||||

James C. Day | 34,757 | 0 | 34,757 | 13,075 | 47,832 | |||||||||||||||

Michael P. Donaldson | 83,674 | 6,231 | 89,905 | 85,529 | 175,434 | |||||||||||||||

Timothy K. Driggers | 207,150 | 6,835 | 213,985 | 73,711 | 287,696 | |||||||||||||||

C. Christopher Gaut | 500 | 0 | 500 | 11,220 | 11,720 | |||||||||||||||

Lloyd W. Helms, Jr. | 97,025 | 5,796 | 102,821 | 126,035 | 228,856 | |||||||||||||||

Michael T. Kerr | 150,000 | 0 | 150,000 | 7,951 | 157,951 | |||||||||||||||

Jeffrey R. Leitzell | 40,452 | 5,008 | 45,460 | 10,887 | 56,347 | |||||||||||||||

Julie J. Robertson | 6,316 | 0 | 6,316 | 2,369 | 8,685 | |||||||||||||||

Donald F. Textor | 68,651 | 0 | 68,651 | 88,002 | 156,653 | |||||||||||||||

William R. Thomas | 722,180 | 53,477 | 775,657 | 227,724 | 1,003,381 | |||||||||||||||

Ezra Y. Yacob | 73,578 | 5,344 | 78,922 | 83,448 | 162,370 | |||||||||||||||

All current directors and executive officers as a group (15 in number) | 1,531,295 | 88,528 | 1,619,823 | 844,409 | 2,464,232 | |||||||||||||||

| (a) | Includes (1) shares for which the person directly or indirectly has sole or shared voting or investment power; (2) shares of restricted stock held under the Amended and Restated EOG Resources, Inc. 2008 Omnibus Equity Compensation Plan (“2008 Stock Plan”) or the EOG Resources, Inc. 2021 Omnibus Equity Compensation Plan (“2021 Stock Plan”) for which the participant has sole voting power and no investment power until such shares vest in accordance with the provisions of the 2008 Stock Plan or the 2021 Stock Plan; |

| (b) | The shares shown in this column, which are not reflected in the adjacent column entitled “Shares Beneficially Owned,” consist of shares of our Common Stock that would be received upon the exercise of stock-settled stock appreciation rights (“SARs”) held under the 2008 Stock Plan by the individuals shown that are exercisable on or before April |

| (c) | Includes (1) RSUs held under the 2008 Stock Plan or the 2021 Stock Plan vesting after April |

| achieved performance multiple for grants for which the applicable performance period has been completed) held under the 2008 Stock Plan vesting after April |

| (d) | None of our directors or “Named Officers” beneficially owned, as of February |

Director Independence

The Board has affirmatively determined that seveneight of our eightten current directors, namely Mses. Clark and Robertson and Messrs. Crisp, Daniels, Day, Gaut, Kerr and Textor, have no direct or indirect material relationship with EOG and thus meet the criteria for independence of Article III, Section 12 of our bylaws, which are available on our website atwww.eogresources.com/company/board-of-directors, as well as the independence requirements of the NYSE and the SEC.

In assessing director independence, the Board considered, among other matters, the nature and extent of any business relationships, including transactions conducted, between (i) EOG and each director, (ii) EOG and betweenan immediate family member of a director and (iii) EOG and any organization for which one of our directors or an immediate family member is a director or executive officer or with which one of our directors or an immediate family member is otherwise affiliated. Specifically, the Board considered, among other things, (1) various transactions in connection with the exploration and production of crude oil and natural gas, such as revenue distributions, joint interest billings, payments for midstream services (i.e., gathering, processing and transportation-related services) or oilfield services (including related equipment and supplies) and payments for crude oil and natural gas, between EOG and certain entities engaged in certain aspects of the oil and gas business for which one of our directors is a director or executive officer or is otherwise directly or indirectly affiliated, (2) payments of dues and contributions to certainnot-for-profit entities (such as trade associations) with which one of our directors or an immediate family member is affiliated and (3) any relationships (employment, contractual or otherwise) between EOG and immediate family members of directors.

Except with respect to Mr.Messrs. Thomas and Yacob, the Board has determined that all such relationships and transactions that it considered were not material relationships or transactions with EOG and did not impair the independence of our directors. The Board has determined that (i) Mr. Thomas is not independent because he is ourwas the Chief Executive Officer (“CEO”). of EOG from July 2013 until his retirement as an employee and the CEO of EOG, effective as of September 30, 2021, and (ii) Mr. Yacob is not independent because he was appointed as CEO of EOG, effective as of October 1, 2021.

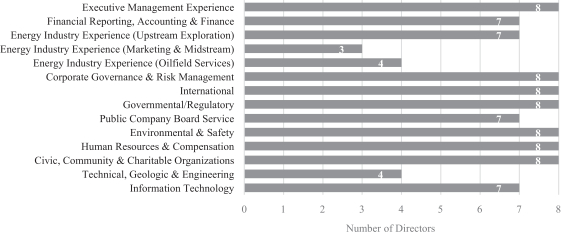

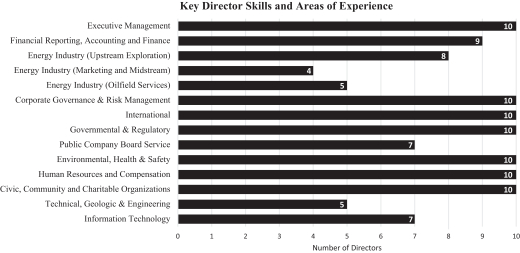

Director Skills and Experience Matrix; Director IndependenceDiversity and DiversityTenure Charts

Please see “Item 1. Election of Directors” below for a description of certain key skills and areas of experience of our director nominees that we believe are relevant to our business, and an accompanying skills and experience matrix forsetting forth the number of our director nominees.nominees that possess each skill and area of experience. Also included in “Item 1. Election of Directors” below are charts regarding the independencediversity and gender diversitytenure of our director nominees.

Meetings

The Board held sixseven meetings during the year ended December 31, 2019.2021.

Each director attended at least 75% of the total number of meetings of the Board and Board committees on which the director served. Our directors are expected to attend our annual meeting of stockholders. All of our then-current directors attended our 20192021 annual meeting of stockholders.

Executive Sessions ofNon-Employee Directors

Ournon-employee directors held sixseven executive sessions during the year ended December 31, 2019. Each of ournon-employee directors during the year ended December 31, 2019 participated in2021. Mses. Clark and Robertson and Messrs. Crisp, Daniels, Day, Gaut, Kerr and Textor attended each of the sixseven executive sessions.

Mr. Textor (i) was appointed by thenon-employee directors as the presiding director for the executive sessions in 20192021, and (ii)Mr. Day has been appointed by thenon-employee directors as the presiding director for executive sessions in 2020 as well.2022. As discussed below, the presiding director is elected annually by and from thenon-employee directors of our Board.

Board Leadership Structure

The Board does not have a policy onas to whether or not the roles of Chairman of the Board and CEO should be separate or combined and, if they are to be separate, whether the Chairman of the Board should be selected from thenon-employee directors or be an employee. The directors serving on our Board possess considerable professional and industry experience, significant and diverse experience as directors of both public and private companies and a unique knowledge of the challenges and opportunities that EOG faces. As such, the Board believes that it is in the best position to evaluate the needs of EOG and to determine how best to organize EOG’s leadership structure to meet those needs. The Board believes that the most effective leadership structure for EOG at the present time is for Mr. Thomas to serve as both Chairman of the Board and CEO.

This model has succeeded because it makes clear that the Chairman of the Board and CEO is responsible for managing our business, under the oversight and review of our Board. This structure also enables our CEO to act as a bridge between management and the Board, helping both to act with a common purpose.

Mr. Thomas has been our Chairman of the Board and CEO since January 2014 and has been with EOG and its predecessor companies for over 41 years. Prior to becoming our Chairman of the Board and CEO, Mr. Thomas served as President and CEO of the company from July 2013 through December 2013, and as President of the company from September 2011 to July 2013. Prior to September 2011, Mr. Thomas served in various leadership positions at EOG, including leadership positions in our Houston, Texas headquarters office and leadership positions in our Fort Worth, Texas, Midland, Texas and Corpus Christi, Texas offices, where he was instrumental in EOG’s successful exploration, development and exploitation of various key resource plays.

Since becoming an independent public company in August 1999, our stock price performance has significantly exceeded the collective performance of our peer group companies as well as the performance of the Dow Jones Industrial Average, the Nasdaq Composite Index and the Standard & Poor’s 500 Index (measured(in each case, measured as of March 13, 2020)February 15, 2022), thus demonstrating,which we believe demonstrates the effectiveness of EOG’sour Board’s determinations from time to time of the appropriate leadership structure.structure for EOG.

Mr. Thomas served as our Chairman of the Board and CEO from January 2014 through September 2021 because, during that period, the Board believed that the most effective leadership structure for EOG was for Mr. Thomas to serve in both roles. Such model was successful, in part, because it made clear that the Chairman of the Board and CEO was responsible for managing our business, under the oversight and review of our Board. Such structure also enabled Mr. Thomas, in his role as CEO, to act as a bridge between management and the Board, helping both to act with a common purpose.

Effective October 1, 2021, we initiated the execution of our management succession plan, pursuant to which Mr. Thomas retired (effective September 30, 2021) from his role as CEO, after over 42 years with the company. Upon Mr. Thomas’ retirement, the Board promoted Mr. Yacob from the role of President to CEO, and Mr. Helms, our Chief Operating Officer, assumed the role of President and Chief Operating Officer. Also as of October 1, 2021, as part of the succession plan, Mr. Thomas transitioned to the role of non-executive Chairman of the Board.

The Board believes that the most effective leadership structure for EOG during the succession process is for Mr. Thomas to serve as non-executive Chairman of the Board and for Mr. Yacob to serve as CEO. As non-executive Chairman, Mr. Thomas has facilitated, and will continue to facilitate, interactions between our Board, Mr. Yacob and our other executive management. Mr. Yacob, in his role as CEO, has acted, and will continue to act, as a bridge between management and the Board, helping both to act with a common purpose.

Further, the Board believes that there iscontinues to be substantial independent oversight of EOG’s management and a strong counterbalancing governance structure in place, as demonstrated by the following:

| • | We have an independent presiding director. The presiding director is elected annually by and from the |

non-employee directors. In addition, our presiding director is afforded direct and complete access to |

| • | We have a substantial majority of independent directors. |

| • | Key committees are comprised solely of independent directors. Our Audit, Compensation and Human Resources and Nominating, Governance and Sustainability Committees are each comprised solely of independent directors. Each of ournon-employee directors serves on each of the committees. |

| • | Non-employee directors meet regularly. Ournon-employee directors typically meet in executive session without our employee director (Mr. |

| • | We have annual director elections. Our stockholders provide balance to the corporate governance process in that each year each director is elected pursuant to the majority voting provisions in our bylaws. Our stockholders may also communicate directly with the presiding director or any other director, as described under “Stockholder Communications with the Board” below. |

Board’s Role in Risk Oversight

Our Board retains primary responsibility for risk oversight. To assist the Board in carrying out its oversight responsibilities, members of our senior management report to the Board on areas of risk to our company. For example, to assist our Board in carrying out its oversight responsibilities with respect to climate change-related risks, members of our senior management discuss climate change and environmental-related matters with our Board throughout the year and, at least annually, review with the Board our environmental performance as well as trends and industry comparisons.

In addition, our Board committees consider specific areas of risk inherent in their respective areas of oversight and report to the full Board regarding their activities. For example, our Audit Committee periodically discusses with management our major financial risk exposures and the steps management has taken to monitor and control such exposures. Further, cybersecurity is an integral part of our risk management and an area of increasing focus for our Board and management. Accordingly, our Audit Committee also (i) oversees, and receives regular reports from our senior management regarding, EOG’s policies, strategies and initiatives for mitigating cybersecurity and information technology risks and (ii) receives reports from, and discusses with, our senior management any cybersecurity incidents we may experience.

Our Compensation and Human Resources Committee incorporates risk considerations, including the risk of losing key personnel and any risks that may be presented by our compensation policies and practices, as it evaluates the performance of our CEO and other executive officers, determines our executive compensation and evaluates our compensation policies and practices. Our Nominating, Governance and Sustainability Committee focuses on issues relating to Board and Board committee composition and provides oversight with respect to environmental, social and governance (“ESG”) matters.

Further, to ensure that our Board has a broad view of our overall risk management process, the Board regularly reviews our long-term strategic plans and the principal issues and risks that we may face, as well as the processes through which we manage risks.

At this time, we believe that combining the roles of Chairman of the Board and CEO enhances the Board’s administration of its risk oversight function because, through his role as Chairman of the Board, and based on his experiences with the daily management of our business as our CEO and previously as our President and in other leadership positions, Mr. Thomas provides the Board with valuable insight into our risk profile and the options to mitigate and address those risks.

The charter for each committee of the Board identified below is available on our website atwww.eogresources.com/company/board-of-directors. Copies of the committee charters are also available upon written request to our Corporate Secretary.

Nominating, Governance and Sustainability Committee

The Nominating, Governance and Sustainability Committee, which is comprised exclusively of independent directors, is responsible for the following, in each case in consultation with the Board and each of the Board committees:

identifying prospective qualified candidates to fill vacancies on the Board;

considering any director nominees recommended by our stockholders pursuant to the procedures set forth in our bylaws (“proxy access” nominees);

recommending director nominees (including chairpersons) for each of our committees;

developing and recommending appropriate corporate governance guidelines;

providing oversight and guidance with respect to ESG and human rights matters;

receiving updates fromengaging with management regarding our ESG activities;activities and human rights matters;

reviewing our annual Sustainability Report; and

overseeing the self-evaluation of the Board.

In considering individual director nominees and Board committee appointments, our Nominating, Governance and Sustainability Committee seeks to achieve a balance of knowledge, experience and capability on the Board and Board committees and to identify individuals who can effectively assist EOG in achieving our short-term and long-term goals, protecting our stockholders’ interests and creating and enhancing value for our stockholders. In so doing, the Nominating, Governance and Sustainability Committee considers a person’s diversity attributes (e.g., professional experiences, skills, background, race and gender) as a whole and does not necessarily attribute greater weight to any one attribute. Further, diversity in professional experience, skills and background, and diversity in race and gender, are just a few of the attributes that the Nominating, Governance and Sustainability Committee takes into account.

While there are no specific minimum requirements that the Nominating, Governance and Sustainability Committee believes must be met by a prospective director nominee (other than the general requirements of our Corporate Governance Guidelines discussed below with respect to director age, director independence and director service on the boards of directors of other public companies), in evaluating prospective candidates, the Nominating, Governance and Sustainability Committee also considers whether the individual has personal and professional integrity, good business judgment and relevant experience and skills as well as other credentials and qualifications, including, but not limited to, the credentials and qualifications set forth in our Corporate Governance Guidelines. In addition, the Nominating, Governance and Sustainability Committee will consider whether such individual is willing and able to commit the time necessary for Board and Board committee service.

Furthermore, the Nominating, Governance and Sustainability Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending individuals who can best perpetuate the success of our business and represent stockholder interests through the exercise of sound business judgment using their diversity of experience in various areas. We believe our current directors possess diverse professional experiences, skills and backgrounds, in addition to (among other characteristics) high standards of personal and professional ethics, proven records of success in their respective fields and valuable knowledge of our business and of the oil and gas industry.

While our Board has no current plans to increase theits size, of the Board, if, in the future, the Board determines that it is appropriate to add a director, the Nominating, Governance and Sustainability Committee will, pursuant to its charter, take into account diversity in professional experience, skills and background, diversity in race and gender, the credentials and qualifications set forth in our Corporate Governance Guidelines and the other attributes and factors described above, in evaluating candidates for such directorship.

Our Corporate Governance Guidelines, which are available atwww.eogresources.com/company/board-of-directors, mandate that:

any director having reached 80 years of age, and each year thereafter, shall discuss with the Chairman of the Board and the Nominating, Governance and Sustainability Committee, and the Nominating, Governance and Sustainability Committee shall affirmatively determine, whether it is appropriate for such director to stand forre-election as a director of the company at the end of his or her current term;

at least three-fifths of our directors must meet the criteria for independence required by the NYSE, the SEC and our bylaws; and

nonon-employee director may serve on the board of directors of more than four other public companies, and our CEO may not serve on the board of directors of more than two other public companies.

As an alternative to term limits for directors, the Nominating, Governance and Sustainability Committee annually reviews each director’s continuation on the Board and regularly assesses the appropriate size of the Board. Our Board and the Nominating, Governance and Sustainability Committee also regularly review the composition, performance and skill sets of the Board and Board committees. In deciding what the Board’s priorities should be for further refreshment, we take into account the results of the Board evaluations; the current composition of the Board; the areas of experience, skill sets and diversity of our directors; and the attributes of potential director candidates.

The Board and the Nominating, Governance and Sustainability Committee also actively seek to create a pipeline of individuals qualified to become Board members, including candidates with diverse ethnic and racial backgrounds and gender diversity.

The Nominating, Governance and Sustainability Committee uses a variety of methods for identifying and evaluating director nominees and considers, from time to time, various potential candidates for directorships. Candidates may come to the attention of the Nominating, Governance and Sustainability Committee through current or former directors, members of executive management, other sources of referral or EOG’s contacts in the business and other professional communities. These candidates may be evaluated at regular or special meetings of the Nominating, Governance and Sustainability Committee and may be considered at any point during the year.

When appropriate and at its discretion, the Nominating, Governance and Sustainability Committee may retain a search firm to assist in identifying candidates for the Board. In such instance, and consistent with the charter of the Nominating, Governance and Sustainability Committee and our Corporate Governance Guidelines, such search firm will be affirmatively instructed to include qualified women and minority candidates for consideration by the Board and the Nominating, Governance and Sustainability Committee.

In addition, the Nominating, Governance and Sustainability Committee will consider nominees recommended by stockholders in accordance with the procedures outlined under “Stockholder Proposals and Director Nominations — Nominations for 20212023 Annual Meeting of Stockholders and for Any Special Meetings of Stockholders” below. The Nominating, Governance and Sustainability Committee will evaluate such nominees according to the same criteria, and in the same manner, as any other director nominee.

The Nominating, Governance and Sustainability Committee held four meetings during the year ended December 31, 2019.2021. The Nominating, Governance and Sustainability Committee is currently comprised of Ms.Mses. Robertson (Chairperson), Ms. and Clark and Messrs. Crisp, Daniels, Day, Gaut, Kerr and Textor.

Audit Committee

The Audit Committee, which is comprised exclusively of independent directors, is responsible for the oversight of our accounting and financial reporting processes, and the audits and reviews of our financial statements.statements and the performance of our internal audit function and independent petroleum consultants.

The Board has selected the members of the Audit Committee based on the Board’s determination that the members are financially literate (as required by NYSE rules) and qualified to monitor the performance of management and the independent auditors and to monitor our disclosures so that our disclosures fairly present our business, financial condition and results of operations.

The Board has also determined that Ms. Clark, an independent director since January 2014 and the Chairperson of our Audit Committee since February 2015, Mr. Textor, an independent director since May 2001 and the Chairman of our Audit Committee from May 2001 until February 2015, and Mr. Gaut, an independent director since October 2017, each (1) have accounting or related financial management expertise in accordance with the requirements of the NYSE and (2) are each an “audit committee financial expert” (as defined in the SEC rules) because each has the following attributes: (1)(A) an understanding of generally accepted accounting principles in the United States of America (“GAAP”) and financial statements; (2)(B) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (3)(C) experience analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of accounting issues that can reasonably be expected to be raised by our financial statements; (4)(D) an understanding of internal controls over financial reporting; and (5)(E) an understanding of audit committee functions. Each of Ms. Clark and Messrs. Textor and Gaut has acquired these attributes by means of having held various positions that provided relevant experience, as described in each director’s biographical information under “Item 1. Election of Directors” below, and, in the case of Mr. Textor, by further having served as Chairman of our Audit Committee from May 2001 until February 2015.

The Audit Committee has sole and direct authority, at its discretion and at our expense, to appoint, compensate, oversee, evaluate and terminate our independent auditors and any other registered public accounting firms engaged to perform audit, review or attest services for EOG, and to review, as it deems appropriate, the scope of our annual audits, our accounting policies and reporting practices, our system of internal controls, our compliance with policies regarding business conduct and ethics and other matters. In addition, the Audit Committee has the authority, at its discretion and at our expense, to retain special legal, accounting or other advisors to advise the Audit Committee. The Audit Committee also reviews and approves the annual Report of the Audit Committee that is included in this proxy statement.

The Audit Committee held seven meetings during the year ended December 31, 20192021 and is currently comprised of Ms.Mses. Clark (Chairperson), Ms. and Robertson and Messrs. Crisp, Daniels, Day, Gaut, Kerr and Textor.

Compensation and Human Resources Committee

TheIn February 2022, the Board renamed our Compensation Committee as the “Compensation and Human Resources Committee” of the Board and assigned to it (in addition to its existing duties and responsibilities discussed further below) the responsibility to provide oversight and review of the company’s human capital management matters and related strategies, programs, policies and procedures.

In addition, the Compensation and Human Resources Committee, which is comprised exclusively of independent directors, is responsible for the administration of our stock compensation plans and for the evaluation and determination of the compensation arrangements for our executive officers and directors. The Compensation and Human Resources Committee is also responsible for reviewing the disclosures in our Compensation Discussion and Analysis and providing the annual Compensation and Human Resources Committee Report, both of which are included in this proxy statement. Please refer to “Compensation Discussion and Analysis — Compensation Process” and “Director Compensation and Stock Ownership Guidelines” below for a discussion of the Compensation and Human Resources Committee’s procedures and processes for making executive officer andnon-employee director compensation determinations. In addition, the Compensation and Human Resources Committee is responsible for reviewing the relationship between our risk management policies and compensation policies and practices and making a determination as to whether any of our compensation policies or practices expose us to risks.

The Compensation and Human Resources Committee is authorized, at its discretion and at our expense, to retain, oversee, obtain the advice of, compensate and terminate such compensation consultants and other advisors as the Compensation and Human Resources Committee deems necessary to assist with the execution of its duties and responsibilities, and is responsible for assessing the independence of any such consultants or advisors and whether any such consultant or advisor has a conflict of interest in respect of its engagement by the Compensation and Human Resources Committee. All of the members of the Compensation and Human Resources Committee qualify as“Non-Employee Directors” under Rule16b-3 under the Exchange Act.

The Compensation and Human Resources Committee held fivefour meetings during the year ended December 31, 20192021 and is currently comprised of Messrs. Daniels (Chairman), Crisp, Day, Gaut, Kerr and Textor and Mses. Clark and Robertson.

Compensation Committee Interlocks and Insider Participation

Messrs. Daniels (Chairman), Crisp, Day, Gaut, Kerr and Textor and Mses. Clark and Robertson serve as members of the Compensation and Human Resources Committee and none of them is a current or former officer or employee of EOG. During the

year ended December 31, 2019,2021, none of our executive officers served as a director or member of the compensation committee (or other committee of the board performing equivalent functions) of another entity where an executive officer of such entity served as a director of EOG or on our Compensation and Human Resources Committee.

Stockholder Communications with the Board

Pursuant to the process adopted by the Board, our stockholders and other interested parties may communicate with members of the Board by submitting such communications in writing to our Corporate Secretary (Michael P. Donaldson), who, upon receipt of any communication other than one that is clearly marked “Confidential,” will note the date the communication was received in a log established for that purpose, open the communication, make a copy of it for our files and promptly forward the communication to the director(s) to whom it is addressed. Upon receipt of any communication that is clearly marked “Confidential,” our Corporate Secretary will not open the communication, but will note the date the communication was received in a log established for that purpose and promptly forward the communication to the director(s) to whom it is addressed. Further information regarding this process can be found on our website atwww.eogresources.com/company/board-of-directors.

Our stockholders and other interested parties can also communicate directly with the presiding director for the executive sessions of thenon-employee directors, or thenon-employee directors as a group, using the same procedure outlined above for general communications with the Board, except any such communication should be addressed to the presiding director or to thenon-employee directors as a group, as appropriate.

Environmental, Social and Governance Matters

Engagement with Stockholders

As stated in our prior public disclosures, EOG is committed to open, collaborative communications with our stockholders; transparency; providing our stockholders with the ability to effectively voice their opinions; being accountable to our stockholders; and operating in an environmentally responsible and safe manner.

Pursuant to these commitments, we have, over the last several years, engaged in, and continue to engage in, substantial, collaborative discussions and correspondence with various EOG stockholders regarding a range of ESG matters. In addition, we have maintained a productive, ongoing dialogue with our investors regarding our public disclosures addressing a range of ESG topics. EOG intends to continue engaging in such discussions and correspondence with our stockholders and to periodically update and expand our related public disclosures.

20182020 Sustainability Report

As evidence of our continuing commitment, EOG published our 20182020 Sustainability Report in September 2019. Like our inaugural 2017 Sustainability Report, our 2018October 2021. Our 2020 Sustainability Report reflects the contributions of many employees across multiple functions throughout the company and, we believe, is a great example of EOG’s multi-disciplinary teamwork and culture and our commitment to sustainability.

In a continuing effort to improveenhance our ESG reporting, our 20182020 Sustainability Report expanded on theour ESG-related disclosures. New disclosures and subjects featured in our inaugural 20172020 Sustainability Report include:

Net-zero ambition for Scope 1 and 2 GHG emissions by 2040

Zero routine flaring by 2025

Sustainable Power Group

Diversity and inclusion working group

Human Rights Policy adoption

Our 2020 Sustainability Report also included expanded workforce diversity metrics. Our 2020 Sustainability Report and introduced new disclosuresour 2021 EEO-1 report (which will be filed in a number2022) are each available in the “Sustainability” section of areas:

|

|

|

|

Our Sustainability Report is available on our corporate website at www.eogresources.com/sustainability.website. Our next2021 Sustainability Report (to be published in the fall of 2020)2022) will contain updated and expanded narrative and quantitative disclosures regarding ourESG-related activities.

2019 Methane Emissions Intensity Rate Goal

As is disclosed in our 2018 Sustainability Report, we set a qualitative goal for 2019 to reduce our methane emissions intensity rate for 2019 below our rate for 2018. As will be further discussed in our next Sustainability Report, we achieved this goal, by lowering our methane intensity emissions rate for 2019 substantially below our 2018 rate.

20202022 ESG Goals for Executive Compensation

As further discussed in the “Compensation Discussion and Analysis” section below, as part of our compensation program, EOG’s executive officers are eligible to receive annual bonuses under an annual bonus planthe EOG Resources, Inc. Annual Bonus Plan (“Annual Bonus Plan”) based on the achievement of operational, financial, and strategic goals established by the Compensation and Human Resources Committee.

These performance goals have historically included ESG-related goals focused on improving our strong safety and environmental record, including reducing our total recordable incident rate and oil spill rates. In 2019, the Compensation and Human Resources Committee expanded the ESG-related goals to also include the reduction of EOG’s greenhouse gas (“GHG”)GHG emissions intensity rate and methane emissions intensity rate, in each case for 2019, below prior year levels.

Based on its review of our compensation program and stockholder feedback, in 2020, the Compensation and Human Resources Committee has established a separately weightedESG-related goal for 2020

performance – specifically, the reduction of each of our GHG, methane and flaring emissions intensity rates, total recordable incident rate and oil spill rates for 2020 below 2019 levels. In 2021, the Compensation and Human Resources Committee added a new performance metric to the separately weighted ESG-related goal, specifically the increase of our wellhead gas capture rate for 2021 above the 2020 level, and increased the weighting of the ESG-related goal for 2021 from 5% to 7.5%.

The Compensation and Human Resources Committee has again established a separately weighted ESG-related goal to evaluate our 2022 performance – specifically, the reduction of each of our GHG, methane and flaring emissions intensity rates for 2022 below 2021 levels, total recordable incident rate and oil spill rates for 2022 below the prior three-year averages and a wellhead gas capture rate for 2022 of 99.8% or higher. The Compensation and Human Resources Committee also again increased the weighting of the ESG-related goal for 2022 – from 7.5% to 10%.

Please see the “Glossary of Terms” included in Annex A for definitions of certain of the terms used above.

Codes of Conduct and Ethics and Corporate Governance Guidelines

Pursuant to NYSE and SEC rules, we have adopted a Code of Business Conduct and Ethics (“Code of Conduct”) that applies to all of our directors, officers and employees, and a Code of Ethics for Senior Financial Officers (“Code of Ethics”) that applies to our principal executive officer, principal financial officer, principal accounting officer and controllers.

You can access our Code of Conduct and Code of Ethics on our website at www.eogresources.com/company/board-of-directors, and any stockholder who so requests may obtain a copy of our Code of Conduct or Code of Ethics by submitting a written request to our Corporate Secretary (Michael P. Donaldson). We intend to disclose any amendments to our Code of Conduct or Code of Ethics and any waivers with respect to our Code of Conduct or Code of Ethics granted to our principal executive officer, our principal financial officer, our principal accounting officer, any of our controllers or any of our other employees performing similar functions on our website at www.eogresources.com within four business days after the amendment or waiver. In such case, the

disclosure regarding the amendment or waiver will remain available on our website for at least 12 months after the initial disclosure. There have been no waivers granted with respect to our Code of Conduct or our Code of Ethics to any such officers or employees or to any of our directors.

Further, we have adopted, pursuant to NYSE rules, Corporate Governance Guidelines, which may be accessed on our website atwww.eogresources.com/company/board-of-directors. Any stockholder may obtain a copy of our Corporate Governance Guidelines by submitting a written request to our Corporate Secretary (Michael P. Donaldson).

In connection with the fiscal year 20192021 audited financial statements of EOG Resources, Inc. (“EOG”), the Audit Committee of the Board of Directors of EOG, during its February 20202022 meeting, (1) reviewed and discussed the audited financial statements with EOG’s management; (2) discussed with EOG’s independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the United States Securities and Exchange Commission; (3) received the written disclosures and the letter from the independent auditors required by the applicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committee concerning independence; (4) discussed with the independent auditors the independent auditors’ independence; and (5) considered whether the provision ofnon-audit services by EOG’s principal auditors is compatible with maintaining auditor independence.

Based upon these reviews and discussions, the Audit Committee has recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements for fiscal year 20192021 be included in EOG’s Annual Report on Form10-K for the fiscal year ended December 31, 20192021 for filing with the United States Securities and Exchange Commission.

| AUDIT COMMITTEE | ||

Janet F. Clark, Chairperson | ||

| Charles R. Crisp | ||

| Robert P. Daniels | ||

| James C. Day | ||

| C. Christopher Gaut | ||

| Michael T. Kerr | ||

| Julie J. Robertson | ||

| Donald F. Textor |

COMPENSATION AND HUMAN RESOURCES COMMITTEE REPORT

The Compensation and Human Resources Committee, in connection with its February 20202022 meeting, has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of RegulationS-K promulgated under the Securities Exchange Act of 1934, as amended. Based on such review and discussions, the Compensation and Human Resources Committee has recommended to the Board of Directors, and the Board of Directors has approved, that the Compensation Discussion and Analysis be included in the proxy statement relating to the 20202022 Annual Meeting of Stockholders.

| COMPENSATION AND HUMAN RESOURCES COMMITTEE | ||

Robert P. Daniels, Chairman | ||

| Janet F. Clark | ||

| Charles R. Crisp | ||

| James C. Day | ||

| C. Christopher Gaut | ||

| Michael T. Kerr | ||

| Julie J. Robertson | ||

| Donald F. Textor |

COMPENSATION DISCUSSION AND ANALYSIS

In this Compensation Discussion and Analysis section, in the executive compensation tables and notes thereto in the “Executive Compensation” section below and elsewhere in this proxy statement, (1) “Named Officers” refers to William R. Thomas, our Chairman of the Board and Chief Executive Officer; Lloyd W. Helms, Jr., our Chief Operating Officer; Timothy K. Driggers, our Executive Vice President and Chief Financial Officer; Michael P. Donaldson, our Executive Vice President, General Counsel and Corporate Secretary; and Ezra Y. Yacob, our Executive Vice President, Exploration and Production; (2)following individuals:

Name | Job Title | |

Ezra Y. Yacob | Chief Executive Officer (effective as of October 1, 2021) | |

Lloyd W. Helms, Jr. | President and Chief Operating Officer | |

Timothy K. Driggers | Executive Vice President and Chief Financial Officer | |

Michael P. Donaldson | Executive Vice President, General Counsel and Corporate Secretary | |

Jeffrey R. Leitzell | Executive Vice President, Exploration & Production | |

| William R. Thomas | Former Chief Executive Officer (effective as of October 1, 2021) | |

Additionally, (1) “peer group,” “peer companies,” “peer group companies” or similar phrases refers to the companies identified under “Compensation Process — Compensation Assessment Tools” below, except as otherwise specified or indicated herein; and (3)(2) certain of the measures referenced below and identified with an asterisk (*) arenon-GAAP measures, for which reconciliations to comparable GAAP measures and related definitions and discussion are included in Annex A. A glossary of certain terms is also included in Annex A.

This Compensation Discussion and Analysis focuses on EOG’s 20192021 compensation programs, actions and outcomes relative to our 20192021 performance. The Compensation and Human Resources Committee (“Compensation Committee”) believes that our executive management team continues to foster a unique culture that has firmly established EOG as a leader in the exploration and production industry.industry and supports our strategy to maximize long-term stockholder value. Our decentralized structure and “pleased but not satisfied” culture encourage innovation and cross-play collaboration, which creates a cycle of continuous improvement and cost reduction. In particular,addition, our shift in focus to “premium”on “double premium” wells has further establishedpositions EOG as the industry leader in creating sustainable value through industry cycles. We are committed to being among the lowest-cost, highest-return and lowest-emissions producers. Our key strategic priorities include:

Returns-Focused – Our “double premium” well strategy requires any new capital to generate at least a 60% direct after-tax rate of return* at flat $40/Bbl WTI oil, $2.50/Mcf HH natural gas and $16/Bbl NGL prices.

Significant Free Cash Flow – We are focused on generating high-return organic growth. We constantly refinefree cash flow to return cash to stockholders and maintain a low-debt profile.

Disciplined Growth – Our growth will be tied to the fundamentals of the oil and gas market.

Sustainability Leader – As a leader in the oil and gas industry, we want to be on the forefront of sustainable business practices and innovation and be part of the long-term energy solution. Based on our proprietary drillingcontinued commitment to improve our strong safety and completion technology and processes to lower costs and improve well productivity, while developing our assets at a disciplined pace that avoids exceeding our learning curve. Underenvironmental record, we increased the leadershipweighting of our executive management team, EOG continuesperformance goal for the annual bonus opportunity for our Named Officers for 2021 performance from 5% to focus7.5% and for 2022 performance from 7.5% to 10%.

In 2021, we delivered on a sustainable business model, which will allow usour strategy to weather market volatilitymaximize long-term stockholder value with outstanding performance and thrive over the long term.significant free cash flow generation. The following are key highlights of our achievements in 2019:2021:

ContinuedReturned $2.7 billion in cash to stockholders with the regular dividend and two special dividends in 2021. Also increased the regular dividend rate by 100% in 2021 compared to the regular dividend rate at the end of 2020.

Delivered record financial performance with record quarterly earnings and free cash flow.

Generated over $5.5 billion of free cash flow* and ended the year with a net debt-to-total capitalization ratio* of -0.5%.

Shifted our focus onreturn hurdle from “premium” wells, requiring at(at least a 30% directafter-tax rate of return* at aflat $40/Bbl crudeWTI oil, price and $2.50/Mcf HH natural gas price.and $16/Bbl NGL prices) to “double premium” (at least a 60% direct after-tax rate of return* at flat $40/Bbl WTI oil, $2.50/Mcf HH natural gas and $16/Bbl NGL prices).

ExceededEarned a 51% all-in after-tax rate of return* based on our production targets despite spending less than expected while generating a 12% return on capital employed (“ROCE”).*

Generated $1.9 billionpremium price deck of free cash flow*flat $40/Bbl WTI oil, $2.50/Mcf HH natural gas and increased our dividend by 31%.$16/Bbl NGL prices.

Added significant “premium” quality playsacreage in multiple basins.

Reduced well costs 7% in 2019 and took steps to further reduce well costs in 2020, with a goal to be one of the lowest-cost oil producers globally.

Maintained a strong balance sheet, ending the year with a netdebt-to-total capitalization ratio* of 13%.

Continued our commitment to safetysustainability and the environment, reducing our recordable incident rate, oil spill rates and methane and GHG intensity rates below lowest previous levels.

EOG’s financial, operational, safety and environmental performance in 2019 was among the bestlong-term energy solutions with a reduction in our company’s history. To appropriately rewardmethane emissions percentage and improvement in our management team’s accomplishments while reflectingwellhead gas capture rate (in each case, based on preliminary estimates of 2021 metrics).

Recognized as a challenging2021 Top Workplace by the Houston Chronicle, the San Antonio Express-News and The Oklahoman.

Successfully executed our CEO leadership transition.

The Compensation Committee viewed management’s 2021 performance as industry environment,leading. Overall, operational and financial results exceeded 2021 objectives and we delivered 2021 total stockholder return of 89%. As a result, our Compensation Committee took the following key actions in 2019,2021, discussed in more detail below:

HeldIn February 2021, increased base salaries flatfor the Named Officers (excluding Messrs. Yacob and deferred any salary increases into 2020 for our Named Officers.Thomas – see related discussion below) to reflect the individuals’ continued growth in their roles and to align more closely with the market.

HeldIn September 2021, enhanced our executive compensation program to incorporate the S&P 500 index as a TSR peer for our 2021 performance-based long-term incentive awards.

In September 2021, granted the same number of shares as 2020 and 2019 to our Named Officers (excluding Messrs. Yacob, Leitzell and Thomas – see related discussion below), resulting in a modest increase in long-term incentive grant levels flat for most of our Named Officers.values from 2019.

Added an annual bonus metric tied to reducing our methane and GHG intensity rates.

PaidIn February 2022, awarded annual bonuses averaging 149%equal to 145% of target to our Named Officers (other than to Mr. Thomas, as he retired from EOG effective September 30, 2021) for 20192021 performance (as described below).

IncreasedEffective January 4, 2021, the weighting on performance units inBoard of Directors appointed Mr. Yacob as our President. Upon his promotion, Mr. Yacob received a one-time, promotional long-term incentive programaward and his cash compensation was adjusted as described under “Executive Compensation Program for 2021” below.

Effective October 1, 2021, we initiated the execution of our management succession plan. Mr. Thomas retired effective September 30, 2021 from his role as Chief Executive Officer after over 42 years with the company (serving as CEO since 2013). Upon Mr. Thomas’ retirement, the Board of Directors promoted Mr. Yacob from President to 60% while reducingChief Executive Officer, and Mr. Helms, EOG’s Chief Operating Officer, assumed the weightingadditional role of SARsPresident. The details of Mr. Yacob’s and Mr. Helms’ pay packages are described below under “Executive Compensation Program for 2021”.

Further, as of October 1, 2021, Mr. Thomas transitioned to 15%,the role of non-executive Chairman of the Board. Mr. Thomas was still in the position of Chief Executive Officer at the time of our 2021 annual long-term incentive grants; however, in anticipation of his retirement and maintaining the weighting of restricted stock/RSUs at 25%, further increasing our executives’ alignmentconsistent with our stockholdershistorical practice, Mr. Thomas only received the performance-based component of the award. The award is subject to performance risk for the full performance period, ensuring a continued tie to our success after his retirement, and requires a minimum of one year of Board service and compliance with restrictive covenants, including non-competition and non-solicitation covenants, in order to vest. Consistent with our long-term performance.practice for all employees, Mr. Thomas was not eligible to receive a 2021 bonus award because he retired prior to the payment of 2021 bonuses.

|

Summary of Pay and Performance Alignment

Our compensation program is designed to align our executives’ long-term realizable pay with long-term performance, with a significant weighting on long-term incentives that are tied to the stock price returns our stockholders experience. The following graphic demonstrates this long-term alignment by showing the amount of target compensation awarded to our CEO over each of the last 5 years and the realizable value of that compensation as of December 31, 2019. The closing price of our Common Stock on the NYSE on December 31, 2019 was $83.76.

|

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||

Target Total Compensation Opportunity (in thousands) | $7,534 | $11,346 | $10,445 | $11,850 | $11,411 | |||||

Annual Bonus Paid as a Percent of Target | 104% | 0% | 125% | 135% | 150% | |||||

Stock Price Performance Since LTI Grant(c) | 20.6% | (11.9)% | (13.0)% | (34.0)% | 11.5% | |||||

EOG TSR Rank over Three-Year Performance Period(d) . | 1 of 9 (achieved) | 3 of 9 (achieved) | 6 of 9 (in progress) | 7 of 10 (in progress) | Begins 2020 |

|

|

|

|

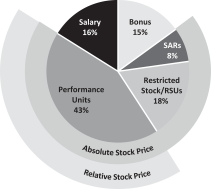

The following charts illustrate that the largest portion of target compensation for our Named Officers as of December 31, 2021 is in long-term equity compensation, consistent with our belief that our executive compensation program should be heavily influenced by our absolute stock price performance to further align the interests of our Named Officers with those of our stockholders. In the case of performance units, the largest single component of our program, compensation is further influenced by relative stock price performance compared to our peers.peers and the broader market. In addition, each of our Named Officers owns a substantial amount of our stock.

TOTAL TARGET

| TOTAL TARGET COMPENSATION

| |

|  |

Say-on-Pay Vote and Key Program Features

At our 20192021 annual meeting of stockholders, the vast majority of our stockholders voted to approve our executive compensation program, with approximately 95%96% approval among votes cast. Based on these voting results and the Committee’s periodicEven with this very strong support, our Compensation Committee regularly reviews of our executive compensation program to identify opportunities to strengthen the program and our executives’ alignment with our stockholders. In 2021, we did not make any significant changes toenhanced our executive compensation program to incorporate the S&P 500 index as a TSR peer for 2019. However, as discussed elsewhere in this Compensation Discussion and Analysis, we did change the weighting of our 2021 performance-based long-term incentive awardsawards. This enhancement diversifies our relative TSR performance measurement beyond the exploration and production (E&P) sector and reflects our broader competition for our Named Officers in September 2019 to further increase the tie between our long-term compensation and long-term stockholder returns and to align with the practices of our peers. investor capital.

Our program continues to reflect an alignment with current governance trends, while maintaining a competitive compensation design to appropriately reward our executive officers for their contribution to the achievement of our short-term and long-term business goals and the creation and enhancement of stockholder value. Certain best practice, stockholder-friendly elements of our compensation program with stockholder-friendly features such as:are described below.

A structured annual bonus plan tied to important operational, financial and strategic goals, including individual bonus targets and metric weightings, while preserving the Committee’s ability to qualitatively assess the performance of our Named Officers.

A significant performance-based component for our Named Officers through long-term performance awards denominated and paid based on our TSR relative to the TSR of our peer companies. As noted above, we have increased the weighting of this component of our long-term incentive awards.

Meaningful stock ownership by, and stock ownership guidelines for, the Named Officers.

Minimal perks and limited supplemental pension benefits.

No employment agreements.

Compensation Program Best Practices | ||

✓ | Strong pay-for-performance linkage between company performance, individual performance and executive compensation outcomes | |

✓ | Significant performance-based pay structure for our Named Officers | |

✓ | Structured Annual Bonus Plan, including bonus targets and metric weightings, tied to key operational, financial and strategic goals | |

✓ | Long-term incentive program with majority of program tied to absolute stock price performance and relative stock price performance against industry peers and broader market | |

✓ | Meaningful stock ownership by, and stock ownership guidelines for, the Named Officers | |

✓ | Minimal perks and limited supplemental pension benefits | |

✓ | No employment agreements | |

✓ | No single-trigger change-in-control severance benefits or excise tax gross-ups | |

✓ | Anti-hedging and insider-trading policies in place | |

✓ | Engagement of an independent compensation consultant reporting to the Compensation Committee | |

Change-in-control protection that does not include a “single-trigger” severance benefit or excise tax“gross-up”.

The Committee’s engagement of an independent compensation consultant.

Our executive compensation program is designed to attract and retain a highly qualified and motivated management team and appropriately reward individual executive officers for their contributions to the achievement of EOG’sour key short-term and long-term goals. The Compensation Committee is guided by the following key principles in determining the compensation of our CEO and other Named Officers:

Objective |

| |

Competitive and Market-Based | • Target compensation • Three-year vesting periods enhance the | |

Pay for Company Performance |

• Performance-based design incentivizes the achievement of a balance of short- and long-term business objectives, key to positioning EOG for long-term success • When goals are not achieved, compensation opportunities will result in below-target outcomes | ||

| Pay for Individual Performance | • Named Officers are held accountable • If individual performance goals are not achieved, compensation opportunities may result in below-target outcomes |

Aligned with Stockholder Interests |

|

| • |

• 78% of CEO pay is directly linked to • Named Officers are subject to stock ownership requirements |

Each of the components of our executive compensation program plays a unique role in meeting our compensation objectives:

Compensation Element | Role in Total Compensation | |

Base Salary | • Provides a competitive level of fixed compensation based on the individual’s role, experience, qualifications and performance | |

Annual Bonus | • Aligns Named • Recognizes individual contributions to our annual performance • Communicates the Board’s evaluation of our annual performance | |

| Long-Term Incentives – Performance Units, Restricted Stock/RSUs, and SARs | • Aligns Named • Creates a meaningful and sustained ownership stake in EOG • Fosters retention through forfeitable awards • Requires | |

Post-Termination Compensation and Benefits | • Provides a competitive level of income protection | |

Benefits – Retirement, Health and Welfare | • Provides financial security for various life events (e.g., disability or death) • Matches benefits generally provided to other EOG employees | |

During each year, the Compensation Committee periodically reviews our executive compensation program and determines whether each component continues to promote our compensation objectives.

The Compensation Committee’s Decision-Making Process